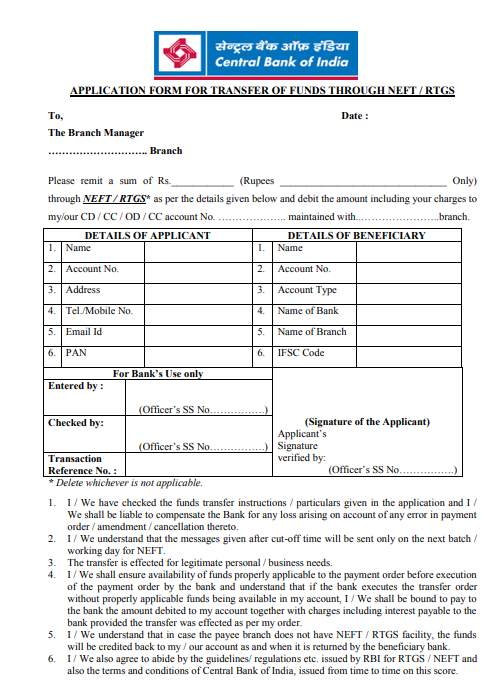

The Reserve Bank of India maintains the RTGS system for interbank transfers (RBI). Customers of the Central Bank of India can use RTGS both online and offline. Clients can fill out the Central Bank of India RTGS Form offline by going to the bank if they want to send high value money using RTGS.

CBI Bank NEFT/RTGS Form PDF

CBI India Central Bank RTGS Fees in 2024 The Central Bank of India (RBI) has instructed the banks to stop levying costs on RTGS transactions begun online using internet banking or mobile banking. However, RTGS transactions started in the bank branch are subject to a small fee. Details are as follows:

Download CBI RTGS form / NEFT Form,

Central Bank of India RTGS form / NEFT Form 2024, Download

| RTGS Timings | RTGS Charges |

| Rs. 2 lakh to Rs. 5 lakh | |

| 8.00 am to 11 am | Rs. 25/- |

| After 11 am to 1 pm | Rs. 27/- |

| After 1 pm to 4:30 pm | Rs. 30/- |

| After 4:30 pm | Rs.30/- |

| Above Rs. 5 lakh | |

| 8 am to 11 am | Rs. 50/- |

| After 11 am to 1 pm | Rs. 52/- |

| After 1 pm to 4:30 pm | Rs.55/- |

| After 4:30 pm | Rs.55/- |