¡Hello there! If you want to increase your CIBC credit card limit, we’ll show you how in a few simple steps. You will most likely need to boost your CIBC credit card limit in order to spend more freely. We will walk you through the procedure and provide some information about this limit at the conclusion of this post.

Process for Increasing CIBC Credit Card Limits

To apply for a credit increase on your CIBC card, you must first complete the following steps:

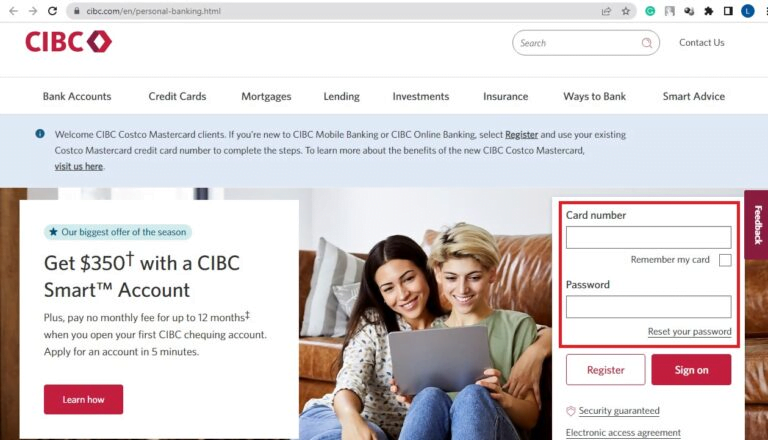

- Go either to the CIBC Online Banking website or the Mobile Banking app.

- To begin the procedure, sign in to your account.

- Choose “Customer Services” from the drop-down menu.

- Select “Apply for a credit limit increase” and follow the on-screen instructions.

- That’s all there is to it! You will need to wait a few days for confirmation. When you receive permission, the required amount will be applied immediately.

If you have any problems requesting the expansion, you may always contact a CIBC representative. For individuals who prefer to request over the phone, they provide a customer service number. If you wish to do it, contact 1-800-465-4653 and request a credit limit increase; they will walk you through the process.

Eligibility for an Increase in CIBC Credit Card Limit

When you first acquire your credit card, the bank determines your credit limit based mostly on your credit history. In other words, any information about your income, debts you have and have not paid, and credit score are considerations in determining your CIBC credit card limit.

The fact is that the bank prefers customers who can pay their credit card payments on time. As a result, if you pay your payments on time and in full, you will most likely earn a high limit. If you have outstanding debts on your credit history, you will obtain a low limit.

However, in order to apply for a raise, you must first meet the following requirements:

- The applicant must be the principal cardholder.

- Your credit card account has been active for at least 6 months.

- In the recent six months, you have not accepted a credit limit increase offer.

- You had an excellent record of bill payment (making at least the minimum amount each month before the invoices were due).

- Your credit card account, of course, must be in good standing.

Is it dangerous to ask for a credit limit increase on my CIBC credit card?

It is always dependent on how you intend to use the new restriction. It is useful in an emergency, such as when paying for medical expenditures. In such situation, you’ll have the peace of mind knowing you have adequate credit accessible for unexpected expenses.

However, having a higher limit implies you may overspend at some time. Remember that if you go above your limit, you will have to pay your expenses with interest. This might harm your credit score and make it difficult to obtain acceptance for other services.

We urge that you use your credit card sensibly, avoiding exceeding half of the available credit. However, you can request a reduction in your CIBC credit card limit at any time. You will have less money to spend, but you will have more opportunities to repay your bills.